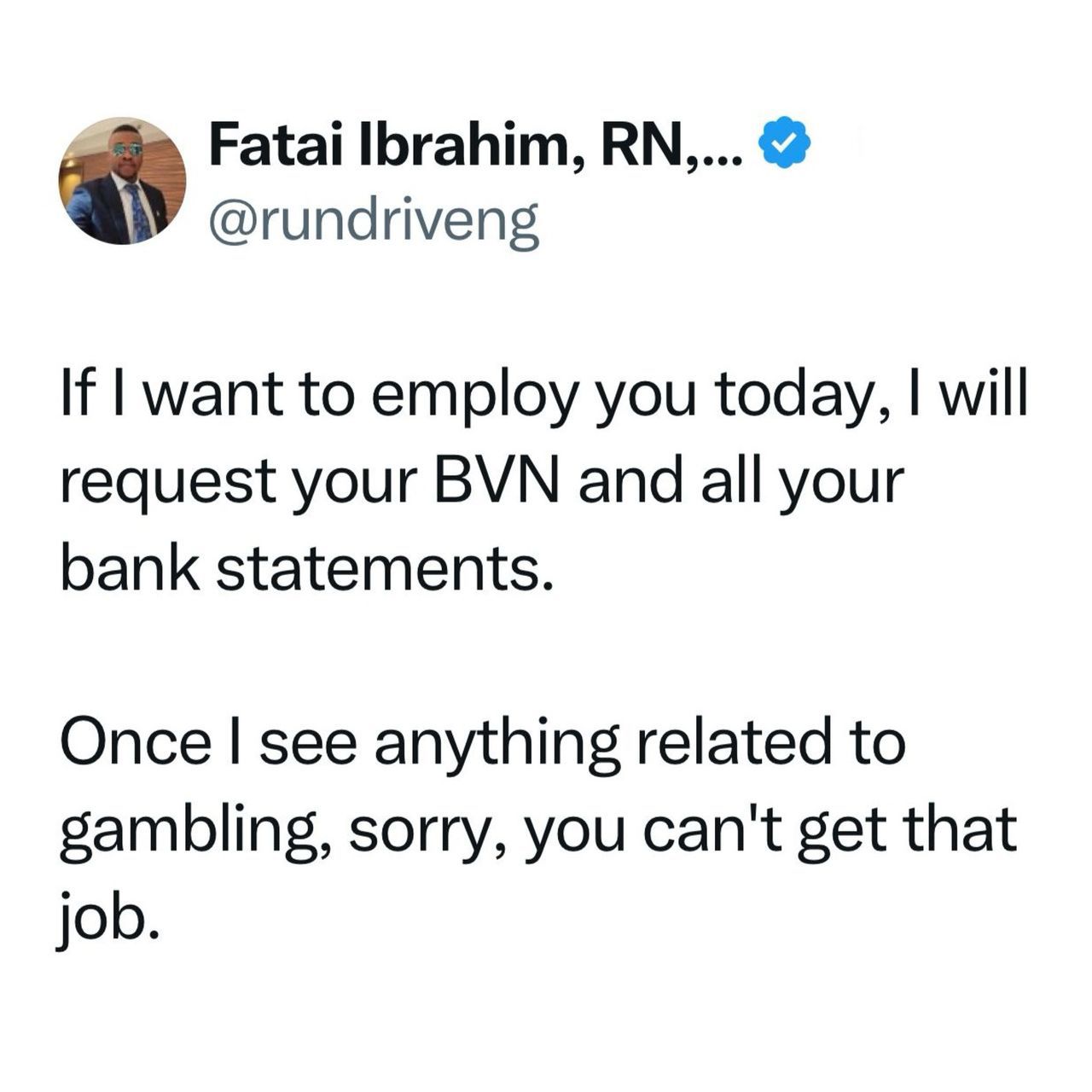

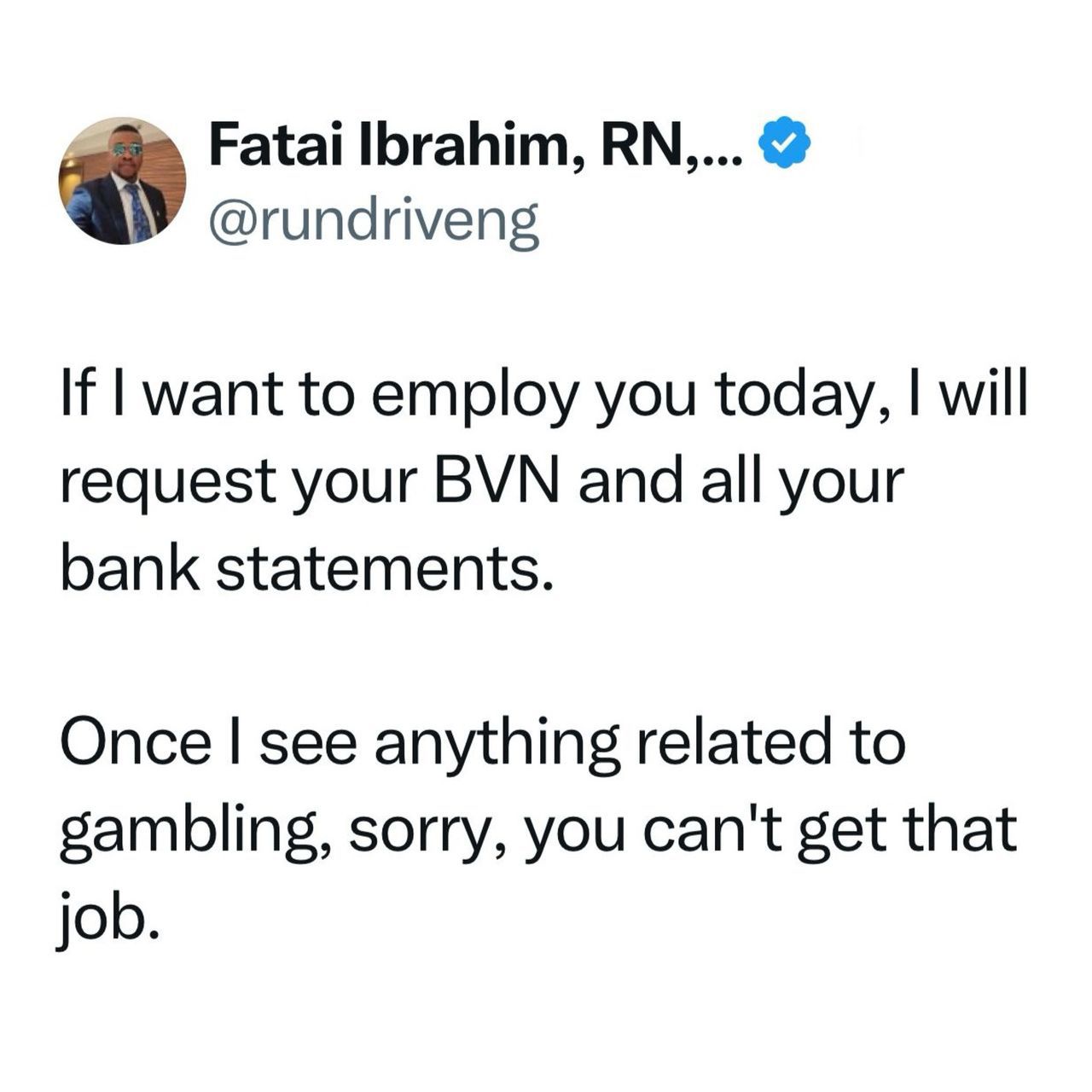

“No Job for Gamblers”: Man Sparks Online Debate Over Hiring Criteria Based on Bank Statements

A heated debate has erupted across social media after a Nigerian man identified as Fatai Ibrahim, a registered nurse, shared his unconventional yet stern hiring standard that has stirred both praise and backlash online. Taking to X (formerly Twitter), Ibrahim revealed that if he were to employ someone, one of the first things he would demand is the candidate’s Bank Verification Number (BVN) and their complete bank statement. His reason? To scan through and detect any trace of gambling activity.

“Ifl [sic] want to employ you today, I will request your BVN and all your bank statements. Once I see anything related to gambling, sorry, you can't get that job,” Ibrahim stated in a tweet that quickly caught fire on social media, generating thousands of reactions within hours. While some internet users hailed his stance as a bold and wise screening mechanism, others condemned it as discriminatory, overly intrusive, and potentially illegal.

The tweet sparked an avalanche of responses, many of which came from HR professionals, job seekers, legal analysts, and average Nigerians, all weighing in with varying perspectives. Supporters argued that gambling can be a red flag, indicating potential irresponsibility or financial instability, especially in roles that demand trust, financial discipline, or direct access to company funds. To them, Ibrahim’s stance wasn't just valid but even necessary in today’s climate where employee integrity can make or break a business.

“This makes a lot of sense,” one user wrote. “You’re hiring someone to work in a sensitive role, maybe they’ll be handling cash, records, or finances. If they’re into sports betting or online gambling, you can’t trust that person not to steal when times get tough.”

Another supporter commented, “A man who can’t control his gambling habit is a risk to the organization. It’s better to be safe than sorry.”

But not everyone agreed. Critics lambasted Ibrahim’s method as an invasion of privacy and an unfair generalization. They argued that indulging in gambling does not automatically make someone a bad employee, nor does abstaining from it guarantee excellence.

“Requesting someone’s entire financial history just to give them a job? That’s wild,” one respondent replied. “What happened to interviews, reference checks, and skill assessments? You want to become the EFCC?”

Legal experts also weighed in, warning that such practices could easily run afoul of labor laws and data protection regulations. In Nigeria, the Data Protection Act stipulates that employers cannot collect sensitive financial information from prospective employees without clear and lawful justification. Requiring a BVN and scrutinizing a person’s bank statement may, in some cases, violate the principle of proportionality in data collection.

“If you’re not a financial institution or a law enforcement agency, what business do you have going through someone’s gambling records?” another critic asked. “That’s private behavior. As long as the employee is not using company time or funds for it, it’s none of your business.”

The tweet also reignited a broader conversation about workplace ethics, personal freedom, and where the line should be drawn when it comes to scrutinizing a potential hire. Is it acceptable to judge an applicant for how they spend their personal money? Should employers have the right to make decisions based on lifestyle choices that do not directly impact job performance?

A few users who identified as recruiters themselves noted that, while background checks are normal, delving into a person’s bank activity is not only rare but could also repel top talent. “As a recruiter, if I asked a candidate for their bank statement, they’d walk away,” one professional wrote. “It sends the wrong message—it says you don’t trust your employees even before hiring them.”

Others took a more nuanced approach. Some acknowledged that while gambling habits can be problematic, Ibrahim’s method was perhaps too black-and-white. “There’s a difference between someone who spends ₦500 on Bet9ja every weekend for fun and someone who bets away their rent money,” another user noted. “Context matters.”

The virality of the tweet also shed light on Nigeria’s gambling culture, particularly among young adults. With betting shops and mobile apps booming across the country, concerns have grown over addiction and its effects on financial stability. Some believe Ibrahim’s tweet, despite its tone, reflects a growing fear among employers that gambling is becoming a societal menace that could creep into professional spaces.

Meanwhile, some job seekers took the post humorously, joking about deleting all gambling-related transactions or opening a separate “clean” bank account for job applications. Memes followed swiftly, mocking how employers may one day start requesting your Netflix history or even prayer attendance logs.

Others sarcastically commented, “Next time, I’ll borrow my uncle’s bank account for job interviews.”

While the online discourse rages on, one thing is certain—Fatai Ibrahim has touched a nerve that reflects a deeper issue in the Nigerian employment landscape: trust. In an economy where job scarcity meets rising fraud, corporate theft, and financial desperation, some employers are adopting more aggressive methods to screen for red flags. But the question remains: how far is too far?

Despite the backlash, Ibrahim has stood by his opinion, replying to a few comments with further justifications. “This is my money and my business,” he wrote. “I reserve the right to choose who works with me. I’m not running a charity.”

Whether his method becomes a trend or gets dismissed as an online outlier, it has undoubtedly triggered an important conversation about the evolving expectations between employers and employees. In a time where digital footprints and financial behaviors are increasingly under scrutiny, job seekers may find themselves navigating more than just CVs and interviews.

As for now, one lesson stands out from this online storm—if your bank alerts are filled with BetKing, 1xBet, or MerryBet, and you’re applying for a job with someone like Fatai Ibrahim, you may want to think twice.