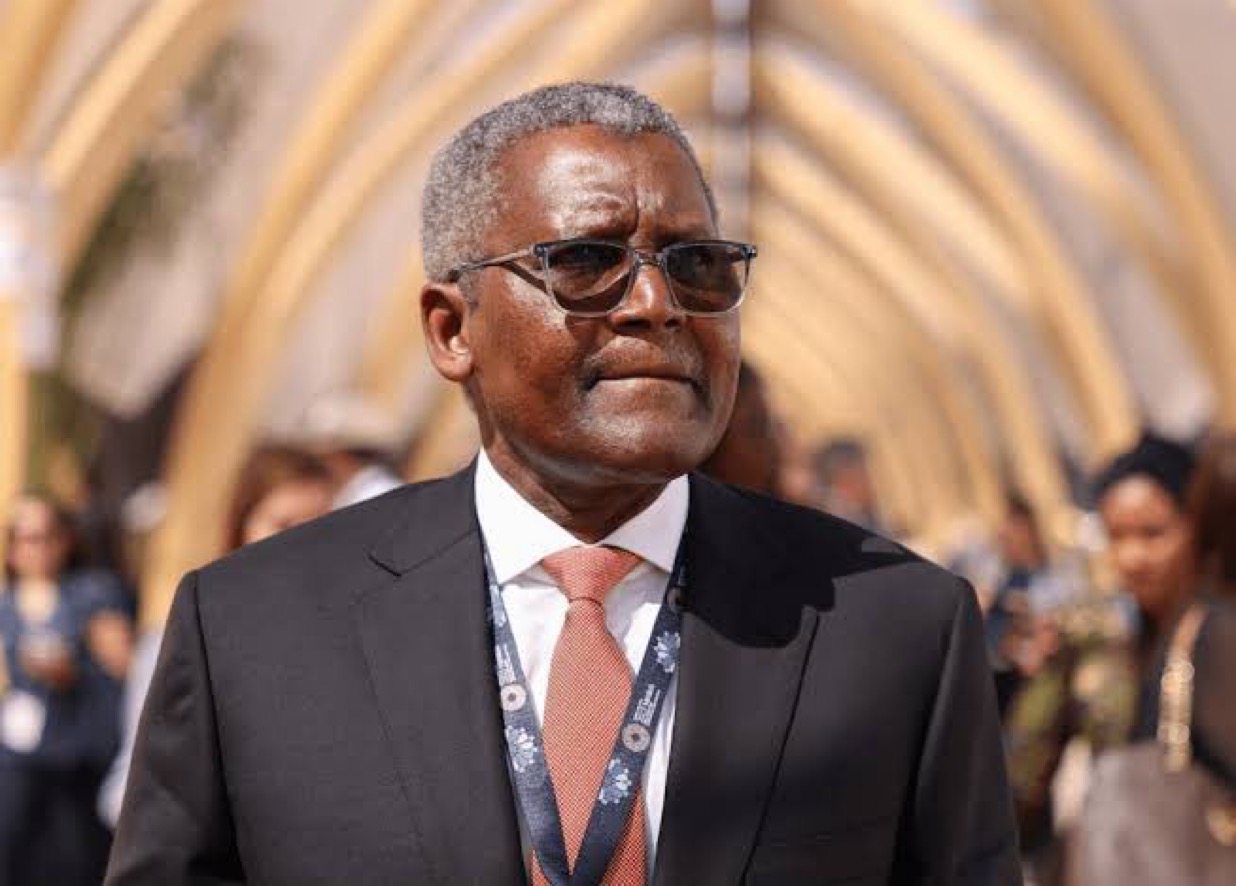

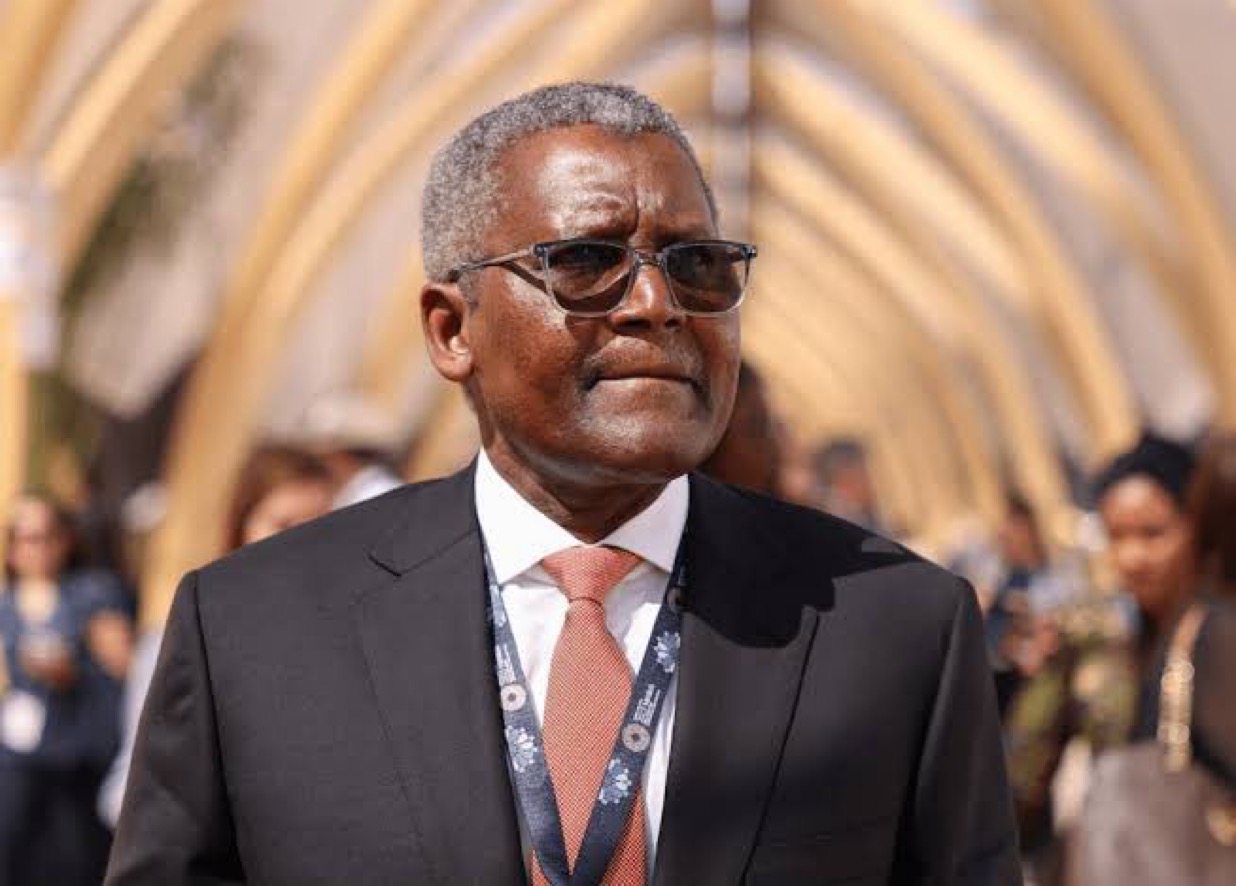

In a move that is already being hailed as a historic economic shift for the nation, Africa’s richest man, Aliko Dangote, has announced that Nigerians will soon have the chance to own a stake in his prized $20 billion Dangote Refinery. The announcement, made earlier today, has ignited widespread excitement, speculation, and strategic positioning across various financial and political sectors in Nigeria and beyond. From Wall Street watchers to traders in Alaba, the buzz is deafening.

Dangote, the President of the Dangote Group and one of the most powerful business figures on the continent, disclosed that a portion of the massive refinery project would be made available to Nigerian investors through a public offering. This game-changing development comes just months after the official commissioning of the refinery by former President Muhammadu Buhari in Ibeju-Lekki, Lagos—a milestone hailed as a new dawn in Nigeria’s economic landscape. The refinery, which is set to significantly reduce Nigeria’s dependence on imported fuel and create thousands of jobs, is now not just an industrial revolution but a potentially life-changing investment opportunity for everyday Nigerians.

In his address, Dangote stated with palpable pride and strategic optimism that the refinery will no longer be a symbol of elite industrial consolidation but will now become a shared national asset. “This is not just a refinery,” he said, “this is a vehicle for national participation, national wealth creation, and national pride. Nigerians deserve to benefit directly—not only through cheaper fuel but also by having a stake in this national project.”

The significance of this moment cannot be overstated. With a refining capacity of 650,000 barrels per day, the Dangote Refinery is the largest single-train refinery in the world. It has been constructed with the bold ambition of transforming Nigeria from a fuel-importing country to a fuel-exporting nation. For decades, the country’s dependency on imported refined petroleum has been a subject of embarrassment, economic drain, and policy failure. The operationalization of the Dangote Refinery has already been forecasted to save Nigeria up to $10 billion in foreign exchange annually and generate another $10 billion in export earnings. Now, by offering shares to the public, it becomes a national treasure open for mutual enrichment.

Market analysts and economists are watching the development closely, with many already projecting an unprecedented frenzy on the Nigerian Stock Exchange once the shares are listed. There is already growing speculation among retail investors, pension fund managers, and international investment bodies on how the equity will be structured. Will it be via a traditional Initial Public Offering (IPO)? Will there be a special allotment for Nigerian citizens or small-scale investors? Will Dangote Industries retain a majority stake, or will a substantial portion be floated to ensure broad-based participation?

Aliko Dangote, always the savvy strategist, was keen to emphasize inclusivity. “This refinery belongs to Nigeria,” he reiterated. “The time has come for Nigerians—students, market women, artisans, and professionals—to own a piece of the engine driving our economic future. This is not a gift. This is not a favour. This is smart economics, and it is long overdue.”

The reaction on social media has been explosive. The announcement, trending under hashtags like #DangoteRefineryShares, #OwnTheRefinery, and #FromOilToOwnership, has attracted commentary from Nigerians in all walks of life. Many expressed excitement about the possibility of investing in a project of such magnitude. “Finally, something big that’s not just for the elites,” tweeted a Lagos-based fintech founder. “I’m ready to own my first real stake in Nigeria.”

Meanwhile, critics and cynics have urged caution. Some have warned about potential over-subscription, price manipulation, and lack of transparency that could mar the noble initiative. “We’ve seen it before,” said a university lecturer on a radio call-in show. “Privatisation often ends up in the hands of the few. Will this be different?”

To that end, financial regulators including the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN) are reportedly working closely with the Dangote Group to ensure the public offering meets all the highest standards of accountability, transparency, and equitable distribution. Sources within both agencies confirm that frameworks are being developed to accommodate retail investors, diaspora Nigerians, and institutional stakeholders in a balanced manner.

The implications of this announcement stretch far beyond the stock market. For many Nigerians, owning a share in the Dangote Refinery represents a rare opportunity to participate in an economic project of national magnitude. In a country where access to wealth creation tools has often felt out of reach for the average citizen, this move promises to be a turning point. Already, financial education platforms and investment firms are ramping up their campaigns, urging clients to prepare for what is being described as a “generational wealth opportunity.”

Banks are also reportedly working on special financing packages to allow small investors to buy into the refinery shares without needing to break the bank. Micro-investment platforms are creating waitlists and advising users to update their KYC documents ahead of the anticipated rush. From high-end investment clubs in Ikoyi to barber shops in Onitsha, the idea of owning a slice of Nigeria’s energy future is inspiring new conversations around financial empowerment, savings culture, and long-term planning.

But beyond the economic euphoria, the emotional and symbolic weight of this development is not lost on Nigerians. For a country that has for years grappled with fuel scarcity, price hikes, subsidy debates, and underperforming public refineries, this feels personal. The chance to convert grievance into gain, and criticism into ownership, is something many didn’t see coming so soon.

Political figures across party lines have reacted cautiously but positively. A former minister of petroleum described the move as “a commendable gesture that must now be matched with systems that protect and prioritize local investors.” Others have urged the government to consider replicating this model across other critical sectors—power, telecommunications, agriculture, and more.

International media outlets including Bloomberg, Reuters, and the Financial Times have also picked up the story, noting its potential to reposition Nigeria on the global energy map. Some have even likened the share offering to the oil-rich Middle Eastern countries opening up their state-owned assets to public investment, such as Saudi Aramco’s IPO.

For Dangote himself, this is yet another testament to his enduring legacy. From cement to sugar, salt to spaghetti, and now oil refining, his empire has spanned the most critical aspects of Nigerian daily life. But perhaps none has carried the weight, ambition, and national expectation quite like the Dangote Refinery.

Insiders say this public offering has been on Dangote’s mind for years. A close associate revealed that the tycoon has always envisioned the refinery as a tool of collective empowerment—not just a private venture. “He has always believed that real success is shared,” the associate noted. “This share sale is not a change of heart. It’s the fulfillment of a long-held belief.”

With the timeline for the public offering expected to be revealed in the coming weeks, Nigerians are now on alert. Stockbrokers are fielding non-stop calls. Business WhatsApp groups are flooded with speculative figures. Everyone is trying to get ahead of what many are calling “Nigeria’s biggest public offering ever.”

Of course, challenges remain. The refinery must maintain operational efficiency. The government must play a supportive regulatory role without interference. Investors must be protected from fraud, speculation, and financial illiteracy. But in this moment, optimism is reigning supreme. The idea that the nation’s largest industrial asset will be owned not just by the elite few but by a cross-section of Nigerians is a radical, refreshing departure from the past.

As evening falls on Nigeria, discussions around kitchen tables, beer parlours, and corporate boardrooms alike are focused on one thing: the Dangote Refinery shares. Everyone, from the apprentice welder in Aba to the tech entrepreneur in Yaba, is asking the same question: “How can I get in?”

Perhaps that is the real victory in this moment—not just the billions of naira that will be raised, not just the fuel independence it promises, but the rekindling of something deeper: belief. Belief in shared prosperity. Belief in economic inclusion. Belief that, just maybe, the Nigerian dream is still alive.

For now, Nigerians wait. But this time, they are not just spectators in another tale of big industry. They are hopeful stakeholders. They are future shareholders. They are, at long last, invited to own a piece of the empire.