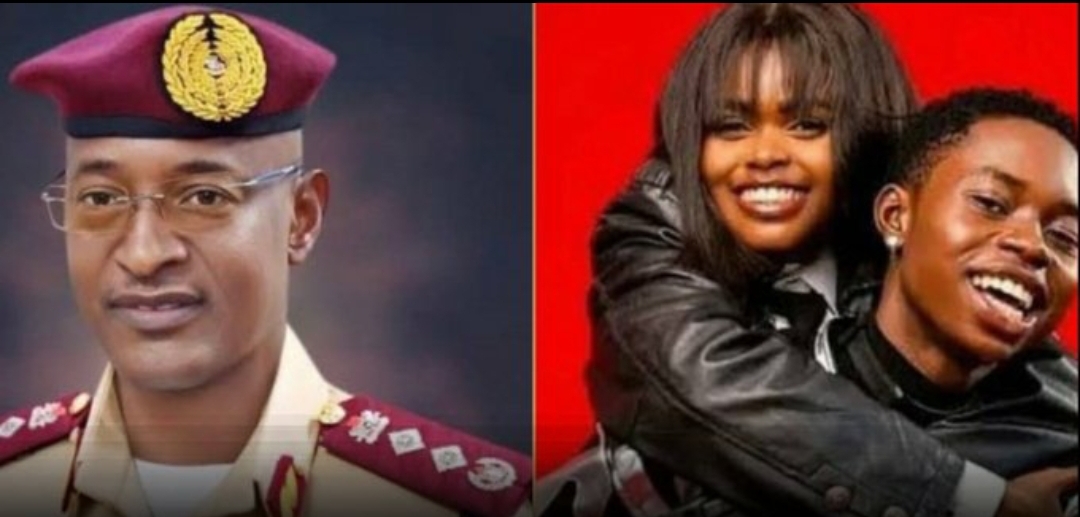

Tech Prodigy or Financial Mastermind? How Forbes 30-Under-30 Star Izunna Okonkwo Became the FBI’s Newest Name in a $41 Million Insider Trading Storm

The story of Izunna Okonkwo, a 30-year-old Nigerian-American tech entrepreneur once hailed as one of the brightest young innovators in the world, has taken a dramatic and unexpected turn as U.S. federal investigators officially identify him as a person of interest in an alleged insider trading and money-laundering ring worth at least $41 million. Once celebrated for co-founding Pastel—a fast-rising fintech company—and earning a spot on the prestigious Forbes 30-under-30 list in 2023, Okonkwo is now facing the darkest spotlight of his career. According to U.S. court filings cited by Peoples Gazette, the Federal Bureau of Investigation believes his meteoric financial success may have been fuelled not only by innovation but by a secret pipeline of stolen corporate intelligence flowing from Wall Street.

Investigators allege that Okonkwo was part of a tightly woven circle of college friends whose long-standing bond morphed into a criminal conspiracy spanning half a decade. At the centre of the alleged scheme is Gyunho Justin Kim, a Citibank investment banker who reportedly abused his position by accessing confidential acquisition details involving major corporations. Instead of safeguarding the sensitive information trusted to him, authorities say Kim repeatedly leaked it to his friend, Saad Shoukat. Prosecutors claim that Shoukat then relayed these market-moving secrets to Okonkwo and other associates, enabling them to place calculated stock trades before major mergers were publicly announced—effectively guaranteeing massive profits while leaving no trace of legitimate market risk.

The FBI says the insider trading operation began modestly but grew steadily as the group became emboldened by their early successes. Over five years, investigators estimate that they collectively earned at least $41 million by leveraging the illicit intel. The trades allegedly showed a consistent pattern: the same individuals purchasing significant stock positions in companies just days before acquisitions were announced, followed by enormous gains as share prices surged. The trading volume, timing, and frequency reportedly caught the attention of regulators, triggering a deeper probe that eventually led to the FBI’s involvement.

For Okonkwo, the allegations strike at the heart of a carefully crafted public image. In the tech space, he built a strong reputation as a visionary co-founder of Pastel, a platform that provides digital tools to small African businesses seeking to streamline operations, track payments, and manage growth with user-friendly technology. The company was celebrated for its mission to empower underserved markets and was widely regarded as one of the standout startups in Africa’s growing fintech ecosystem. Okonkwo, who had often shared stories of humble beginnings and ambitious dreams, quickly became a poster child for diaspora excellence—an immigrant success story written in the language of innovation, talent, and hard work.

But now, a different narrative is unfolding—one involving secret financial channels, encrypted communications, suspicious transactions, and a friendship network prosecutors say functioned like a covert investment cartel. The allegations are not just damaging; they represent a complete contradiction to the values of transparency and ethical leadership Okonkwo once claimed to champion through his work in the African tech community.

Court documents cited by Peoples Gazette indicate that the insider information primarily involved upcoming corporate acquisitions—one of the most sensitive and legally protected categories of financial data in banking. When companies plan to buy or merge with another firm, even the slightest leak can dramatically alter stock prices, allowing informed individuals to make millions overnight. U.S. financial law strictly prohibits such conduct, categorising it as insider trading, a felony that, if proven, carries severe penalties including prison terms, massive fines, forfeiture of illicit gains, and lifelong market bans.

The alleged scheme reportedly functioned in a simple but highly effective chain. Kim, using his insider access at Citibank, would obtain details about pending acquisition deals. He would allegedly pass this information to Shoukat, who prosecutors say served as the coordinator and central messenger of the group. Shoukat then sent the intel to Okonkwo and other traders in the circle, encouraging timed stock purchases. Once the acquisition news became public and stock prices soared, the group would sell their positions, splitting millions in illegal profits.

Investigators say that Okonkwo, who had a history of investing in tech and financial markets, used his sophistication to execute highly strategic trades that yielded unusually consistent returns—returns that analysts later flagged as suspiciously predictive. Patterns such as these are often the starting point of insider trading probes, as no investor, however skilled, can naturally achieve such success without access to privileged information.

Although Okonkwo has not yet been arrested or formally charged as of the latest filings, being named a “person of interest” places him squarely in the crosshairs of a rapidly expanding federal investigation. Legal experts note that this designation typically means authorities believe the person possesses crucial information or may have played a direct role in the alleged crime. The FBI's interest suggests that the probe is entering a more aggressive phase, and Okonkwo’s next move could determine whether he eventually faces criminal charges.

For the Nigerian tech community, the news has landed like a bombshell. Okonkwo was widely regarded as one of the new-generation innovators reshaping Africa’s digital economy. His achievements inspired countless young entrepreneurs who saw him as proof that global impact was possible regardless of birthplace. Now, many are grappling with the possibility that one of their most celebrated figures may have been entangled in a long-running financial fraud that undermines the credibility of the very ecosystem he helped elevate.

Meanwhile, legal analysts warn that the fallout could be far-reaching. If indicted, Okonkwo may face extradition to the United States. Pastel, the company he helped build, could also come under heightened scrutiny from investors, regulators, and partners seeking to distance themselves from potential reputational damage. The broader diaspora community, which embraced him as a rising star, is watching closely, waiting to see whether the evidence presented by investigators will result in formal charges or whether Okonkwo will present a defence that reshapes the narrative.

For now, the case remains fluid, with more revelations expected as the FBI continues its investigation. What is clear, however, is that a young man once celebrated as a symbol of global African excellence is now caught in the centre of one of the most stunning insider trading allegations in recent years—a dramatic fall from grace that underscores how quickly a life built on ambition can be overshadowed by accusations of greed, secrecy, and betrayal.

As the world waits for the next chapter in this unfolding saga, the question remains: was Izunna Okonkwo an unwitting participant, an opportunistic investor, or a key player in a multimillion-dollar financial conspiracy? Only the coming months will tell, but the ripple effects of this case have already begun to reshape conversations about integrity, ambition, and accountability in the global tech community.